Sept 01, 2022

Whether you call it income and impact, purpose and profit, mission and money, for-profit-for-good or impact funding, it all filters into the same bucket - doing good through a commercial model rather than a purely philanthropic approach.

From venture builders like Zinc who are building an ecosystem of impact-led businesses and founders, through investments funds like Revent who are funding to scale impact ventures, to charity-designed and funded startups like GoodPAYE who were developed, supported and funded by the third sector. There’s a myriad of different ways you can explore generating funds whilst also delivering your mission.

Ella Goldner, Zinc

As the UK economy continues to hurtle towards an increasingly terrifying 2023, many households are rapidly analysing their budgeted spend and looking to cut costs wherever possible. With the price cap predicted to breach £6,000 in April next year, families are faced with the very real and heartbreaking choice whether to heat or eat.

Independent think-tank The Resolution Foundation believes the poorest fifth of UK households will have to cut back 24% of their non-essential spending to afford the increase in energy bills in January-March 2023.

In an environment where traditional income streams like sponsorship and events were already struggling post covid, and regular charitable giving is likely to become one of the first casualties for many households, exploring commercial models can be a way for charities to fund the delivery of services in new and innovative ways.

Exploring mission-driven commercial innovation isn’t a quick fix, and working with entrepreneurs is going to be a shock for old models of charity risk management and governance, but the potential for long-term return could offer new models for delivering social good and tap into billions of pounds of unrealised potential income for the third sector.

It’s a short-hand way of articulating our belief that charities could be delivering their mission in a new, more effective way by monetising the assets, skills, capabilities and services they have.

We don’t think charities appreciate their full financial potential and as a result the sector is sitting on billions of pounds of unrealised potential income.

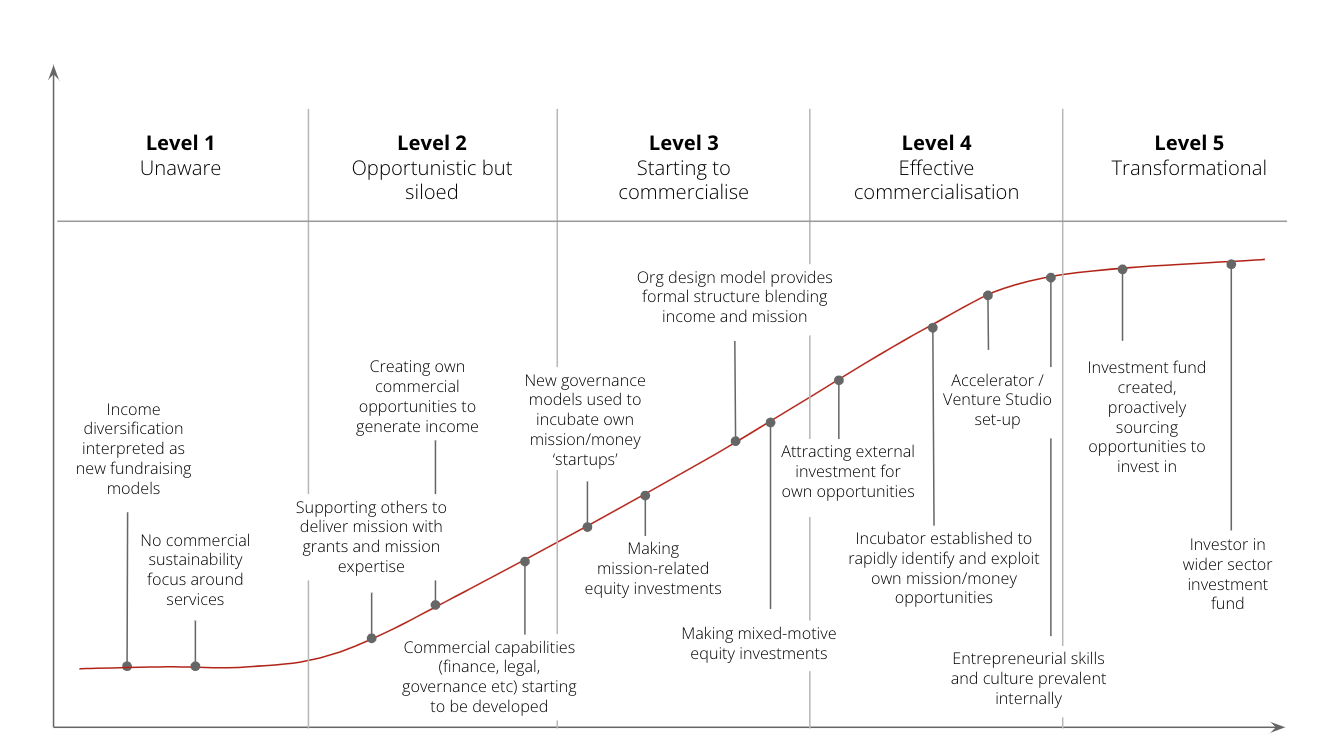

In practice, impact and income is a catch all term for a spectrum of activities. On one end there’s more opportunistic commercialisation – seeking and creating new ways to generate income within the existing structure of the organisation.

In the middle you have strategic commercialisation which might include making your own mission related equity investments or attracting external funding and incubating your own impact and income ‘start ups’.

At the truly transformational end of the spectrum there’s charity owned, mission related investment funds, set up to proactively source opportunities aligned to your goals to invest in. Again, delivering financial return while exploring and supporting new innovative ways to deliver your mission.

We've developed a maturity curve to help you map where your organisation is now, and where you want to be in the future.

There’s a lot of jargon in this space so we thought it would be useful to explain the difference between the main mechanisms of developing and scaling startups.

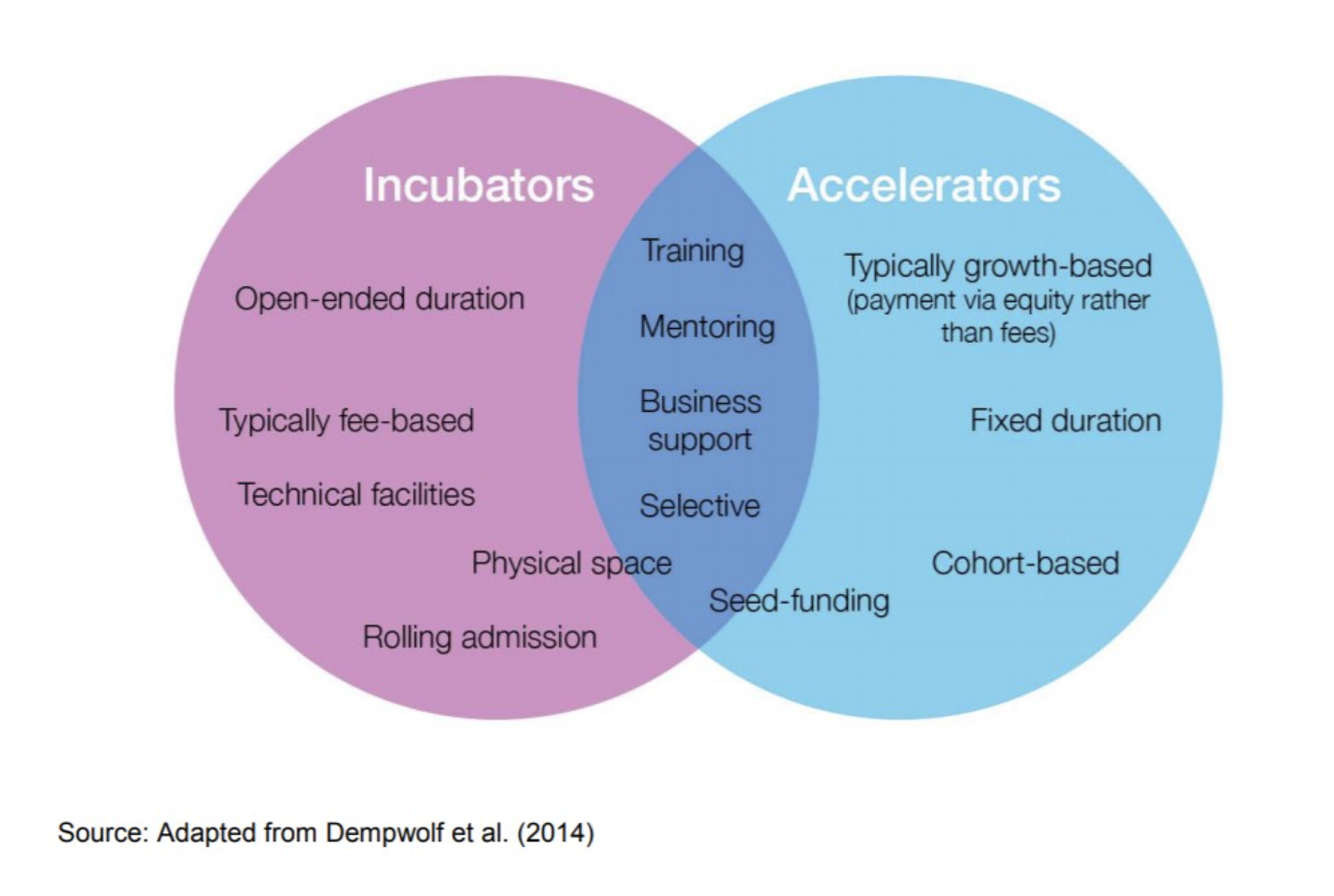

Incubators

Incubators provide resources like physical space and mentorship at the foundational stages, even if you don’t have a fully-fledged business plan. Often all you need is the germ of a good idea.

Since many incubator programs have open-ended timelines, there is less pressure on going straight to market and more focus on refining ideas and developing investment-ready pitches.

Accelerators

Accelerators help early-stage startups scale and quickly get their product to market. They offer mentorship and investor access to accelerate growth over a short period.

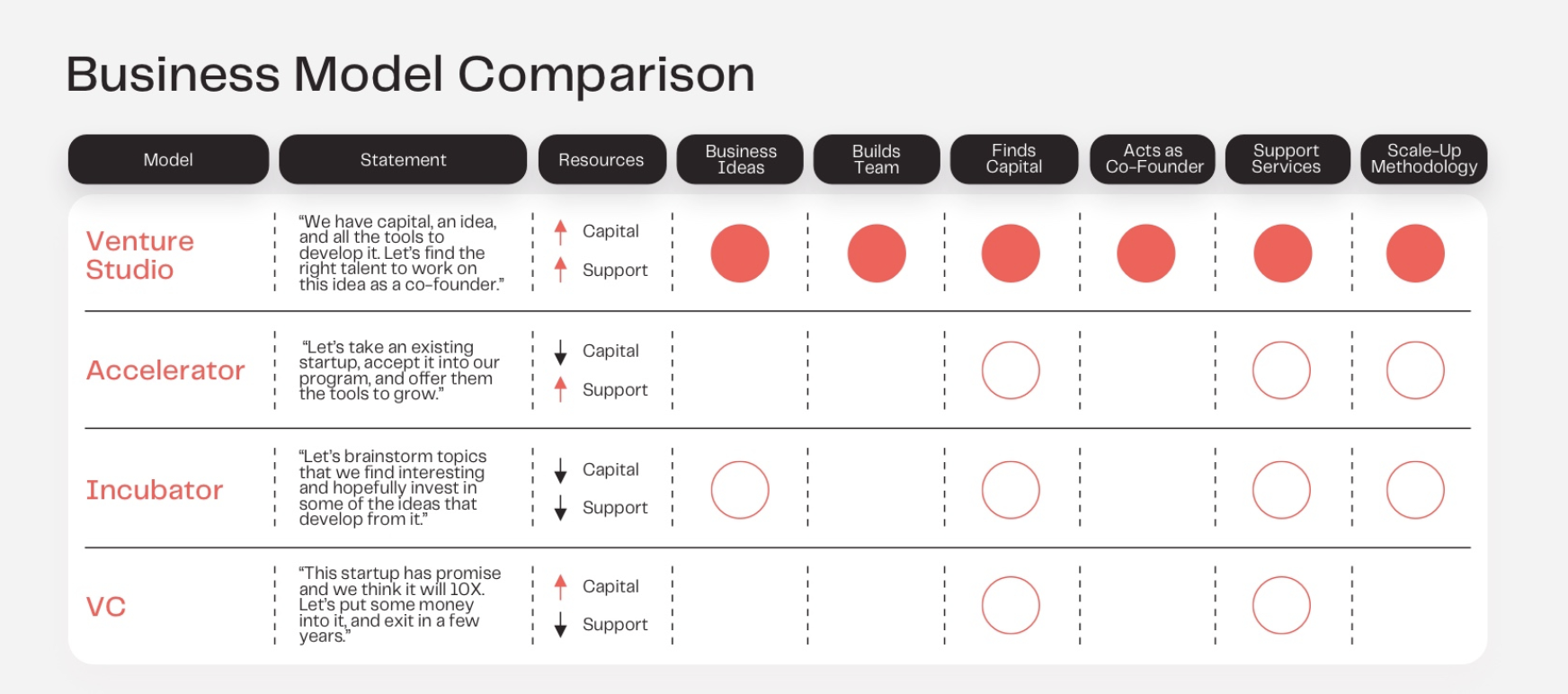

Venture Studios

An estimated 90% of startups will fail. This is where the venture studio model comes in. Venture studios present a different approach to launching startups than incubators or accelerators.

Venture studios help entrepreneurs grapple with the unknowns of building a new company by providing them with an initial capital amount and operational support. A venture studio’s main goal is to found as many successful startups as possible — all from the ground up.

Venture Studios or Venture Builders are companies that have their own funds, in-house experts, and resources to dedicate to building startups.

[Source]

Ella Goldner, co-founder of Zinc, spoke at the Good Futures safari on the future of funding. During her session she shared how the Zinc model works, what makes them different and what she’s learned along the way.

Since launch they’ve backed 150 founders who’ve built 45 companies. They did this on £3m initial investment. The Zinc model supports people for 6 months on the programme, with a £12k stipend. This support encourages people to take risks away from their day to day. After this period Zinc decide which companies to invest in - normally 50% of the companies in the pool (roughly 15 companies at a time). These companies are given a £75k convertible loan note at 13%.

Here are some of our favourite takeaways from the session:

Catch up on Ella's talk below.

From the sector we have the Venture Studio from Crisis. They build, invest in, and scale ventures that end homelessness for those experiencing it, or prevent homelessness from happening in the first place.

The primary aims of the studio are to:

The studio provides access to industry expertise, user testing groups, funding, and a range of technical, business and product support to accelerate businesses that are driven to end homelessness.

You can read their 2020-2021 impact report here and catch up on some of their most recent investments here.

I started Beam because I felt powerless: how could I make a real difference to people affected by homelessness? With Beam, I and over ten thousand other people are able to virtually 'meet' people affected by homelessness on our website beam.org and can fund the specific financial barriers they face. We're trying to create an amazing donor experience in terms of transparency and efficiency: you can see exactly where your donation goes via transparent budgets, share the journey of each person you support through email updates, and have the peace of mind that every single penny goes towards lifting someone out of homelessness for good.

Alex Stephany, Founder

[Source: Forbes]

When I first had children I would get a knot in the pit of my stomach every time I had to refresh their clothes when they grew or the seasons changed. I hated the process of sorting through their outgrown clothes…it always seemed so expensive to buy new ones from the ethical brands I preferred. And more importantly for me I never knew what to do with the old ones. I felt so guilty at the thought of throwing them away but had no one to hand them on to and no time to sell them. It felt like the current system needed a complete overhaul to consider how we could access childrenswear temporarily when we needed it and then keep it in circulation for someone else to have it next. And so the idea of a shared wardrobe was born.

Exploring, designing, investing and launching commercial ventures requires culture change from charities. Great ideas can be killed by getting stuck in the charity machine. Entrepreneurial talent needs different models of support and compensation.

That’s why we’ve created 15 challenge cards outlining the most common challenges we’ve seen at Good Innovation when working with charities to develop or invest in new commercial income streams. The goal of these cards is to help you prioritise the biggest challenges you currently face, and then offer some starter questions to help you explore how you can overcome these hurdles.

Here’s a few of the most common challenges:

LOST - Don’t know where or how to start - so don’t start at all.

It can be difficult to know when to start when organisations are big and opportunities could be anywhere. Opportunities can exist anywhere in the organisation. With too many staff to ask, lots of ideas can surface, creating unrealistic expectations that need to be managed.

Analysis Paralysis - Too much thinking. Not enough progress.

Startup investors don’t ask for five year financial forecasts of new ideas, they buy into the vision, the opportunity, the team and the plan for the next round of funding. New ideas in charities aren’t treated this way, they’re subjected to repeated financial modelling and analysis.

Catch 22 - Ideas killed through being caught in the machine.

Governance is not built for pace and agility. Decisions need to be made by Trustees who meet quarterly. Finding space is hard on an Exec team agenda that’s occupied by the day to day priorities, meaning decisions that should take hours take months.

Starved - No investment to create, no investment to scale.

It can be challenging enough to invest sufficient resources to work on developing new models and new opportunities, but then finding the investment to grow and scale big new ideas can be impossible. New ideas can be doomed to fail without sufficient investment behind them.

Zinc have proved it’s possible to effectively, at scale, commercialise mission-led ventures. So much so that they’ve raised another £28m to do more. Social enterprises like Beam, B Corps like The LIttle Loop and mission-ventures like Belu prove that the for-profit-for-good model works. And collaborative startups like GoodPAYE show that it’s possible for the sector to come together to design and fund commercial solutions.

New approaches to income generation require new thinking, new models and, probably most importantly, new approaches to risk management and governance. Risk needs to be approached differently and analysed differently. How can you support your key decision makers (your board and trustees) on this journey? Do you have the right talent in house to help guide you through the process? Do you have the right processes and prioritisation to ensure opportunities don’t get missed or ideas don’t get lost in the weeds of governance?

We believe that charities are sitting on massive commercial potential. The potential to turn their expertise, assets and insights into for-profit ventures. What makes your organisation unique? What skills do you have that could serve a new audience, market or problem? Where’s your opportunity to turn your mission into money?

Invest in others to help scale their mission ventures. You could follow Crisis’ lead to build a venture studio to source, support and invest in ventures that align with your mission. Or you could partner with organisations like Zinc to spread the risk of investment through a fund.

Entrepreneurs are looking for partners and experts to help test, validate, grow and scale their startups. Charities have access to these knowledge and insight pools. Don’t fear working with entrepreneurs. They need and want your help.