Jul 26, 2022

Even before Covid-19 hit, cash was already in decline. Come 2022, we were all encouraged to ditch the cash in favour of contactless payments as an additional safety precaution, with the limit pushed up from £30 to £45. Cash payments dropped to 17% of all payments in 2020.

Many shops, cafes and other establishments went one step further in only accepting card payments, forcing people to become more comfortable with tapping rather than rattling through a coin purse.

In 2020, 72% of Brits used online banking & 54% now used mobile banking, whilst only 0.5% of payments were made using cheque. 13.7m consumers didn’t use cash at all.

October 2021, and the contactless limit went up to £100, which made paying on plastic an even more convenient option.

The pandemic however, cannot be wholly to blame for the rise of card and app payments. In 2019, before Covid-19 arrived in the UK, only about 2.1 million people used cash for their day-to-day spending, and cash was used for less than 30% of purchases.

Cash still offers a freedom and control that digital money and crypto can’t just yet. 5% of Brits still have a piggy bank for small change - the ‘rainy day fund’. And let’s not even start on the £50m in loose change that is currently circulating down the back of sofas and in the filter of washing machines.

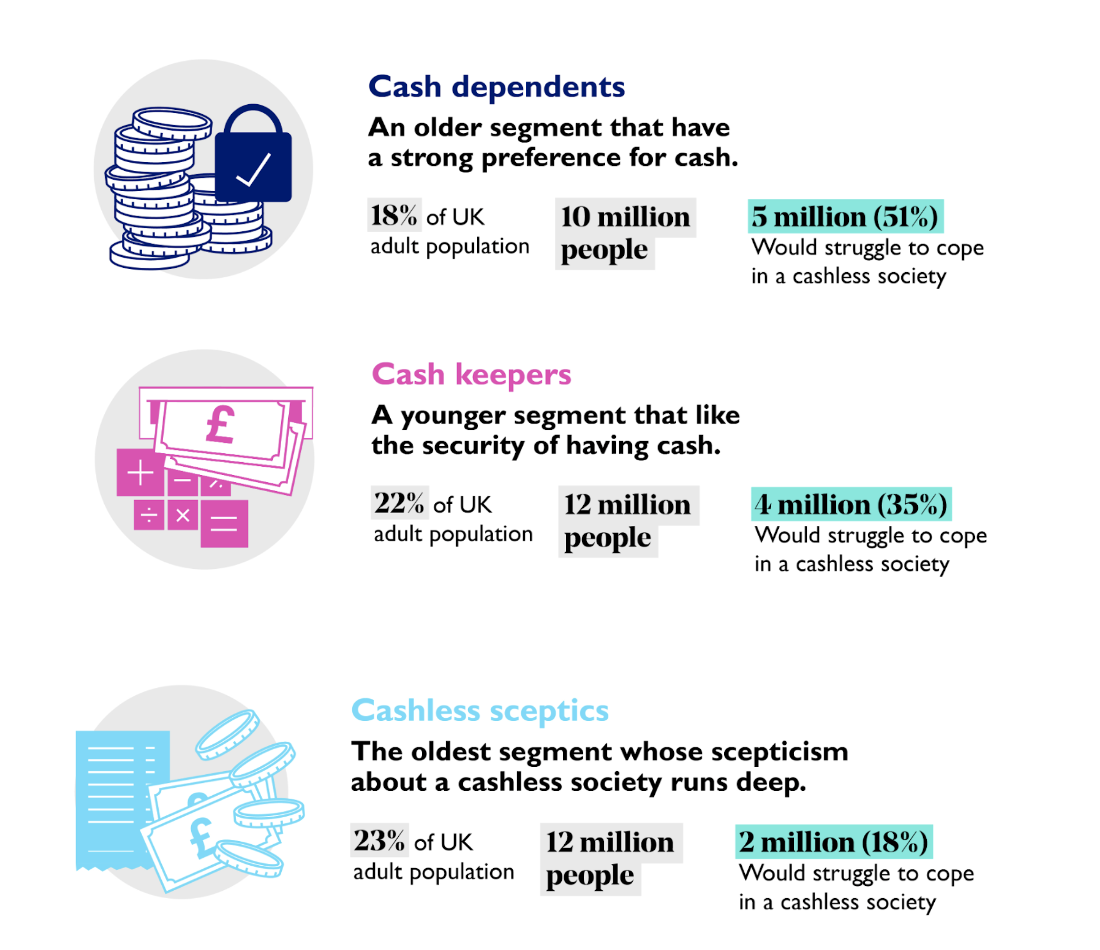

According to the RSA, 10 million people would struggle if the UK went cashless tomorrow. 1.2 million UK adults are ‘unbanked’. 18-24 year olds are the most likely to be unbanked, accounting for 23% of all unbanked adults.

Cash dependents rely on cash for budgeting and financial management. Whilst Cash keepers make frequent and small withdrawals. Some, who have experienced online fraud or know someone who has, can be understandably concerned, whilst others continue to be sceptical about their privacy.

[Source: RSA Cash Census, 2022]

Cash isn’t quite dead. Yet. Cash collections have been a staple of charity fundraising for decades. But the collection tin has evolved.

Contactless technology provider GoodBox saw the number of individual contactless donations it handled increase from 32,000 in May 2019 to 78,000 in May 2021, while over the last 12 months donations through the CollecTin More have increased from around £50,000 in March 2021 to £240,000 in March 2022.

From QR codes to contactless enabled collections, fundraisers need the right tools to make the most of a cashless economy.

The new Financial Services and Markets Bill (announced in the Queen’s speech this year) will ensure continued access to cash withdrawal and deposit facilities across the UK.

So what?