Jul 26, 2022

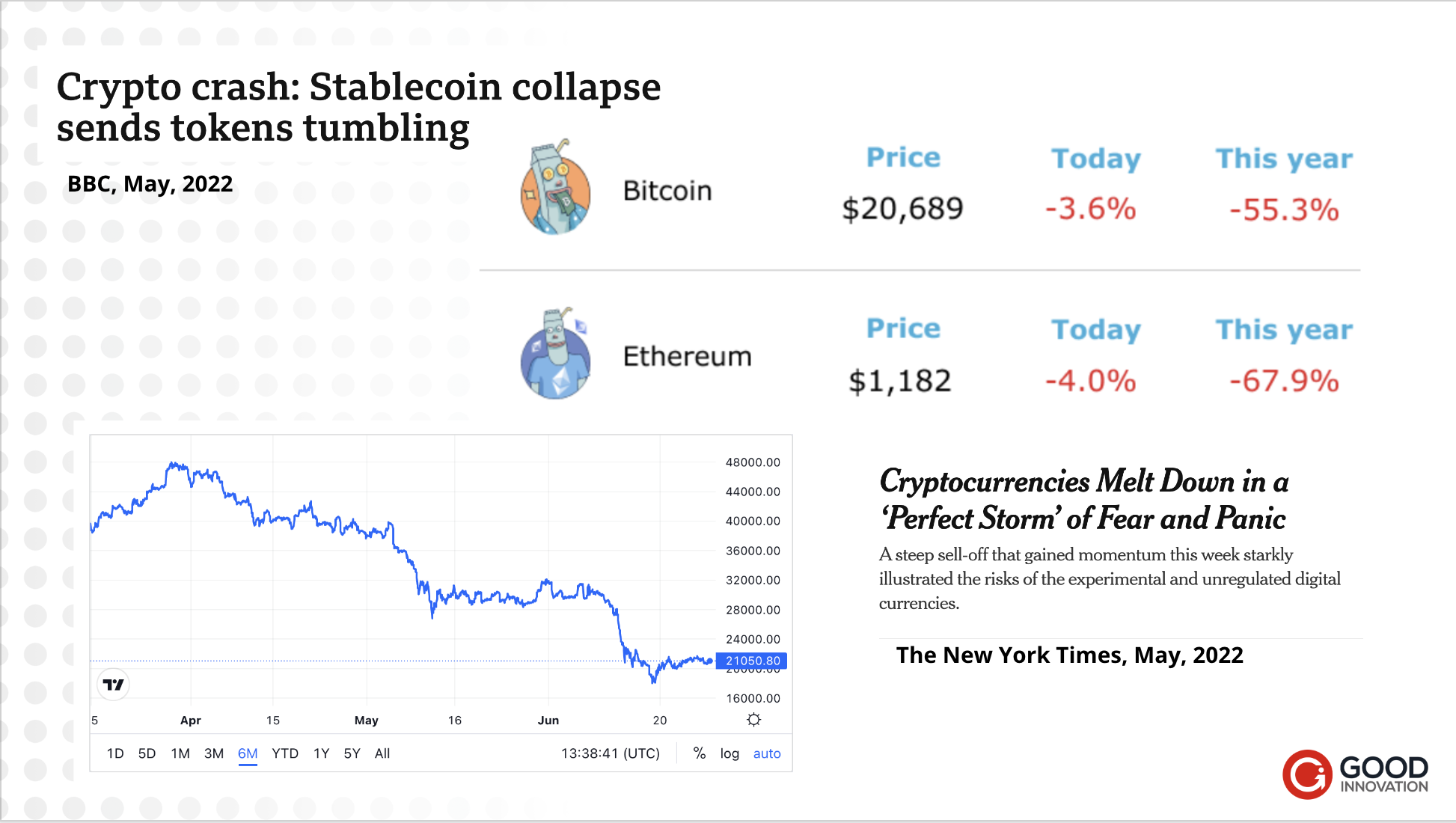

Before we dive in, let’s acknowledge the elephant in the room - cryptocurrencies haven’t had the best 2022. There was the stablecoin Ponzi scheme that was Terra collapsing in May, which sent shockwaves through the value of currencies like Bitcoin and Ethereum.

Then Tesla and Elon threw a curveball. In their first quarter earnings this year, Tesla (a long time investor and believer in cryptocurrencies) wrote, “We believe in the long-term potential of digital assets both as an investment and also as a liquid alternative to cash.” On 14th March 2022, Elon Musk tweeted “I still own & won’t sell my Bitcoin, Ethereum, or Doge fwiw.”

Roll on 20th July 2022, and Shock! Horror! Elon Musk went back on his word and dumped 75% of Tesla’s holdings in Bitcoin, taking a loss of $162m, throwing the market into another existential spiral.

However none of this is new. Cryptocurrencies are inherently volatile (and the market has a really short memory). They’re still in their infancy (Bitcoin launched in 2008). Their price fluctuates because it’s influenced by supply and demand, investor and user sentiments, government regulations, and media hype. All of these factors work together to create price volatility.

Keeping this in mind, we’re going to take a dive into the emerging world of digital money and cryptocurrencies to consider the question: Is the future of money digital? And should you be accepting crypto donations?

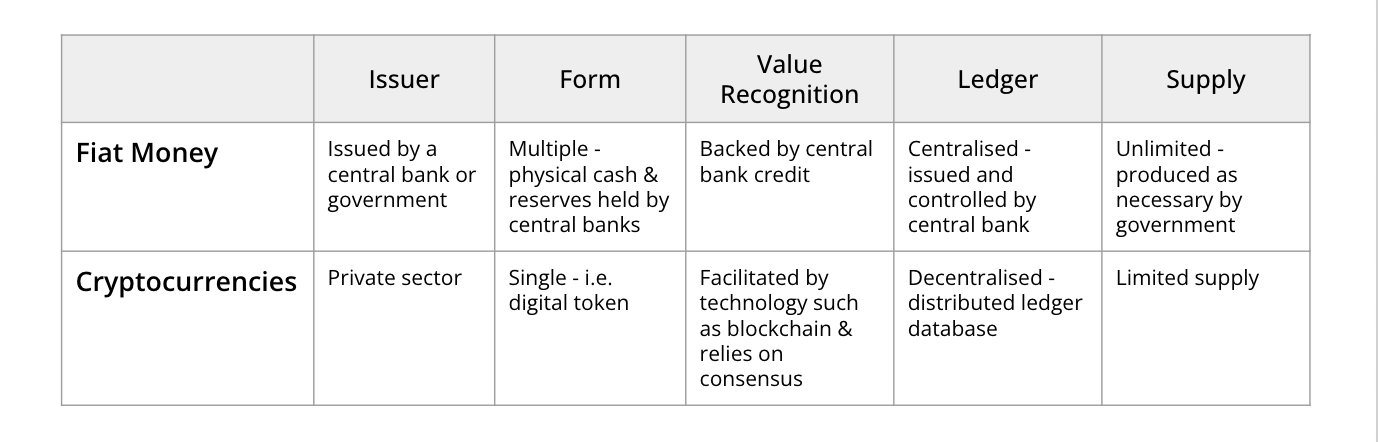

Fiat money is a national currency that is not pegged to the price of a commodity such as gold or silver. The value of fiat money is largely based on the public’s faith in the currency’s issuer, which is normally that country’s government or central bank.

Cryptocurrencies are digital currencies underpinned by blockchain, a technology that creates a public, immutable ledger of financial transactions. There are lots of cryptocurrencies, but the most commonly known are Bitcoin and Ethereum as the two biggest and most widely traded.

Central Bank Digital Currency: These are like the halfway house between traditional fiat money and cryptocurrencies. Why mention them? Because the Bank of England is currently exploring the potential of CBDC for the UK (nicknamed the digital pound or BritCoin). They plan on launching a consultation later this year and we believe the charity sector needs a voice in these conversations.

New audiences

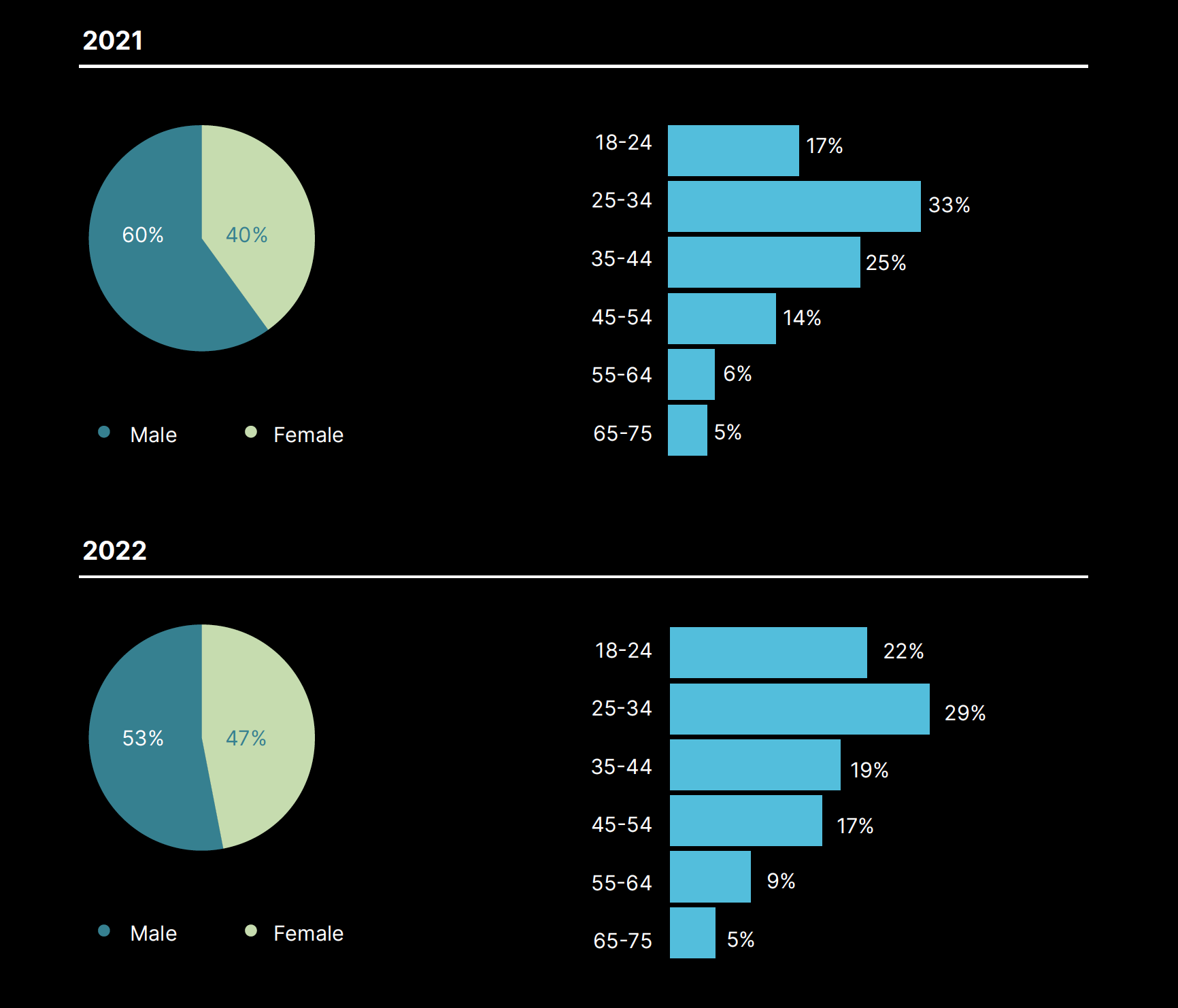

The old view of investors is that they are young, male and childless (the crypto bro stereotype). But 2022 data suggest investors are younger, generally 18-44, less likely to own their own home, but they are more likely to have children/dependents. They hold investments across a range of platforms and are early adopters of smart & green tech. Their biggest motivation to hold crypto is the long term potential - they’re investors.

[Source: Gemini Global State of Crypto 2022]

For many, they’ve accrued more wealth simply through holding crypto in their wallets, and they want to share some of this wealth. However, this new audience may prefer to donate anonymously, for many reasons.

Serving the Unbanked

Today, over 1.7 billion adults worldwide are excluded from the formal financial system. This means nearly a third of all adults—including 8% of people within advanced economies —lack access to traditional banking services, including savings accounts, credit, loans, and insurance.

Cryptocurrencies can start to resolve this issue by spreading digital commerce around the globe so that anyone with a mobile phone can start making payments.

For example, in Afghanistan where there have been almost no remittances through international bank payments since August 2021 (when the U.S imposed new restrictions). Afghans, and particularly Afghan women, have turned to crypto to receive and send funds.

When Money isn’t Money

In the UK, cryptocurrency is not recognised as 'currency' or a form of legal tender, however it is now considered 'property'. English Law identifies two forms of property: things in possession (physical items), things in action (a right capable of being enforced). So when accepting a crypto donation, it’s more like accepting the deed to a house than it is cash. Get you legacy teams in your innovation loop to help navigate.

Should you liquidate or hold

Like any ‘property’ donation you need to decide whether to hold onto the asset or liquidate it for the cash value. And with this decision you need to factor in the volatility of the price, and the tax implications.

The Environmental impact

Old school crypto mining is energy intensive. Proof of work consensus protocol (used by Bitcoin and Ethereum) is particularly heinous. But there are alternatives. Ethereum is moving to proof-of-stake, whilst there are a host of others that are aiming to not just be carbon neutral, but carbon positive in the future.

Anonymity

In the crypto community anonymity is a big thing. When considering anonymous donations, there are probably three routes you can take:

Rather than jumping straight away to number 3, go back to the insight and consider why someone might want to donate anonymously.

Criminality

Criminality and fraud are probably the biggest concerns we hear from charities when considering whether to accept crypto donations. However, chain analysis gives transparency and can be more traceable than hard cash. Recently launched blockchain tools like GiveTrack and Alice are able to openly track the flow of donations from donor to donee.

2021 was a big year for crypto-philanthropy. The Giving Block, one of the most established crypto donation platforms, saw the annual volume of crypto donations jump from $4.2 million in 2020 to $69.6 million in 2021, an increase of 1,558%!!

The average crypto donation was $10,455, up 236% from $3,109 in 2020. On average, nonprofits received $69,644 in crypto donations in 2021, via The Giving Block, an increase of 66% from the average $44,000 in 2020.

That’s almost $70k of income they wouldn’t have otherwise received.

Closer to home, Edinburgh Dogs & Cats Home received 26 ETH — worth $121,784 in 2021 (£87k). The donation will ensure that the organisation's pet food bank service can run for the whole of 2022.

When Ukraine’s president, Volodymyr Zelensky, declared martial law, the central bank suspended most currency trading and froze the official exchange rate. It also banned digital money transfers.

Ukrainians scrambled to withdraw cash, and the value of the Hryvnia plummeted on informal exchanges. But as the need for fast funds grew, Ukraine looked to crypto assets to help its war effort.

As of July 2022, the government has raised the equivalent of $100m in crypto. Non-government organisations are raising funds too. Come Back Alive, a Ukrainian NGO that has collected money for military equipment and training since 2014, relies on crypto after it was kicked off Patreon, a fund-raising platform that accepts donations in fiat currency but does not allow them to be spent on military apparatus.

UkraineDAO, a crypto collective, auctioned a non-fungible token (NFT) of a Ukrainian flag for $6.5m-worth of Ethereum. It is the tenth most expensive NFT ever sold according to Elliptic, an analytics firm. The proceeds will be spent on humanitarian aid.

Donations solicited in crypto pale next to those raised in fiat currencies. Governments and institutions such as the IMF have between them given billions of dollars in aid to Ukraine. It helps that Ukraine was already crypto-friendly. In 2021 the country ranked fourth in the world for crypto adoption.

Yes! (But that doesn’t mean you need to jump straight on the NFT bandwagon). There are donors out there who want to support your cause, and want to use crypto to do it.

And despite the rocky start to 2022, there’s still a lot of optimism and faith in the future of crypto. VCs are still pouring money into digital currency and blockchain startups, and many believe it’s when, not if, the value of Bitcoin will smash $100k.

Our advice?